Single Female Home Buyer Trends

Women Surpassing Single Men in the Home Buyer Markets

Let's rewind 44 years to 1981—a time when the Post-it Note made its debut, IBM introduced its first microcomputer, and Dolly Parton dominated the Billboard charts with 9 to 5. That same year, the National Association of REALTORS® launched the first Profile of Home Buyers and Sellers and uncovered a surprising trend: single women were purchasing homes at a higher rate than single men, second only to married couples. Fast forward to today, and single women continue to defy expectations, securing homeownership despite earning lower household incomes in an increasingly expensive market. Now, let’s see how they compare to their single male counterparts as they pour themselves a well-earned “cup of ambition.”

What’s remarkable about single women homebuyers is that, until 1974, they were legally required to have a co-signer to obtain a mortgage. Before the Fair Housing Act prohibited sex-based discrimination in housing transactions and the Equal Credit Opportunity Act extended protections, it was common for widows to need a male relative to co-sign. Women had no legal means to challenge such lending discrimination under federal law.

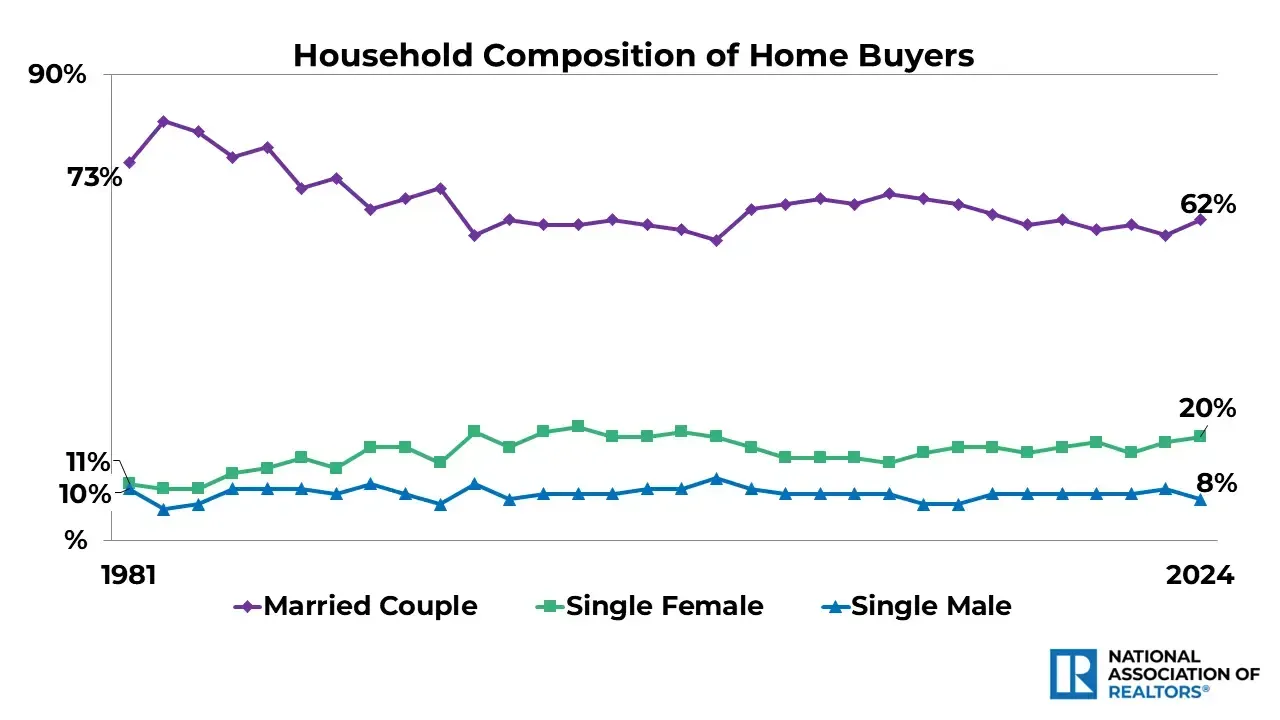

In 1981, married couples made up 73% of homebuyers, while single women accounted for 11% and single men for 10%. Today, those numbers have shifted: 62% of buyers are married couples, 20% are single women, and 8% are single men. The highest recorded share of single women homebuyers was in 2006 at 22%. Between 2016 and 2024, their share has consistently ranged from 17% to 20%. In contrast, single men peaked at 12% in 2010 but have since remained between 7% and 9% of homebuyers in recent years.

Among first-tiAmong first-time homebuyers, the presence of single buyers has become even more notable. In 1985, married couples made up 75% of first-time buyers, but today that figure has dropped to just 50%. Meanwhile, single women in this category have increased from 11% in 1985 to 24% in 2024. Recent data also shows that the share of single male first-time buyers has risen modestly from 9% in 1985 to 11% in 2024.

A common explanation for the rise in single women homebuyers is the overall decline in marriage rates. According to U.S. Census data from the 1950 American Community Survey, 23% of Americans aged 15 and older had never been married. In 2024, that figure has climbed to 34%. But why are more women purchasing homes while men are not? The answer lies in who is buying and their household composition. Both men and women commonly cite the desire for homeownership as a primary reason for buying. However, significantly more women purchase homes to be closer to friends and family. Life changes, such as a shift in family circumstances, can also influence buying decisions. While current data captures whether a buyer is single at the time of purchase, it does not indicate if they were previously married and are now divorced or widowed. Still, proximity to loved ones tends to be a greater priority for women. Interestingly, men are more likely than women to cite retirement as a reason for purchasing a home, with 7% of male buyers compared to 4% of female buyers.

Another factor contributing to the higher homeownership rate among single women is household composition. Single women are more likely to have children under 18 living with them and are slightly more inclined to buy multi-generational homes. Homeownership provides stability in both cases—ensuring children can stay in the same school district and avoiding potential disruptions caused by rising rents. Women who purchase multi-generational homes may also benefit from predictable housing expenses, whether accommodating adult children who have returned home or elderly relatives moving in. By securing homeownership, they eliminate uncertainty in their living situations.

Finances play a crucial role in these trends as well. Single women typically purchase their first home with a median household income of $71,300, compared to $87,500 for single men. While men earn less than married or unmarried couples—both of whom have median household incomes in the six figures—their higher earnings give them more purchasing power than single women. This disparity highlights the challenges of affordability, especially considering that the median income of single women repeat buyers remains lower than that of men purchasing their first home.

To achieve homeownership, women often make greater financial sacrifices than men. Forty-four percent of single women report cutting expenses to afford a home, compared to 37% of single men. These sacrifices include reducing discretionary spending on nonessential goods, entertainment, and clothing, canceling vacations, and even taking on additional jobs. The lengths to which single women go to afford a home underscore its importance to them, as they are more likely than men to move in with family or friends temporarily to save money for a down payment.

These efforts take time and may contribute to the higher median age of single female buyers. The median age for first-time single women buyers is 40, compared to 34 for single men. However, for repeat buyers, the median age levels out between the two groups, suggesting that life and career milestones may still be occurring later in life.

Regardless of how they achieve it, one thing is clear—single women are determined to become homeowners and willing to make sacrifices to reach their goal. For a deeper dive into these trends, explore the full Profile of Home Buyers and Sellers report.

me homebuyers, the presence of single buyers has become even more notable. In 1985, married couples made up 75% of first-time buyers, but today that figure has dropped to just 50%. Meanwhile, single women in this category have increased from 11% in 1985 to 24% in 2024. Recent data also shows that the share of single male first-time buyers has risen modestly from 9% in 1985 to 11% in 2024.

A common explanation for the rise in single women homebuyers is the overall decline in marriage rates. According to U.S. Census data from the 1950 American Community Survey, 23% of Americans aged 15 and older had never been married. In 2024, that figure has climbed to 34%. But why are more women purchasing homes while men are not? The answer lies in who is buying and their household composition. Both men and women commonly cite the desire for homeownership as a primary reason for buying. However, significantly more women purchase homes to be closer to friends and family. Life changes, such as a shift in family circumstances, can also influence buying decisions. While current data captures whether a buyer is single at the time of purchase, it does not indicate if they were previously married and are now divorced or widowed. Still, proximity to loved ones tends to be a greater priority for women. Interestingly, men are more likely than women to cite retirement as a reason for purchasing a home, with 7% of male buyers compared to 4% of female buyers.

Another factor contributing to the higher homeownership rate among single women is household composition. Single women are more likely to have children under 18 living with them and are slightly more inclined to buy multi-generational homes. Homeownership provides stability in both cases—ensuring children can stay in the same school district and avoiding potential disruptions caused by rising rents. Women who purchase multi-generational homes may also benefit from predictable housing expenses, whether accommodating adult children who have returned home or elderly relatives moving in. By securing homeownership, they eliminate uncertainty in their living situations.

Finances play a crucial role in these trends as well. Single women typically purchase their first home with a median household income of $71,300, compared to $87,500 for single men. While men earn less than married or unmarried couples—both of whom have median household incomes in the six figures—their higher earnings give them more purchasing power than single women. This disparity highlights the challenges of affordability, especially considering that the median income of single women repeat buyers remains lower than that of men purchasing their first home.

To achieve homeownership, women often make greater financial sacrifices than men. Forty-four percent of single women report cutting expenses to afford a home, compared to 37% of single men. These sacrifices include reducing discretionary spending on nonessential goods, entertainment, and clothing, canceling vacations, and even taking on additional jobs. The lengths to which single women go to afford a home underscore its importance to them, as they are more likely than men to move in with family or friends temporarily to save money for a down payment.

These efforts take time and may contribute to the higher median age of single female buyers. The median age for first-time single women buyers is 40, compared to 34 for single men. However, for repeat buyers, the median age levels out between the two groups, suggesting that life and career milestones may still be occurring later in life.

Regardless of how they achieve it, one thing is clear—single women are determined to become homeowners and willing to make sacrifices to reach their goal. For a deeper dive into these trends, explore the full Profile of Home Buyers and Sellers report.

Citations

"Just the Facts, Ma'am: Single Women Home Buyers Since 1981"

Author: Jessica Lautz

Published Feb. 12th, 2025

National Association of Realtors - Blog Post

SHARE THIS POST!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465