From Search to Sold: Buying a Home in Today’s Real Estate Market

Buying real estate is one of the most significant financial decisions a person can make—and in today’s fast-paced, competitive market, having a smart real estate buying strategy is essential. Whether you're a first-time buyer or a seasoned homeowner, understanding the buying process, local market trends, and how to position yourself for success can mean the difference between landing your dream home—or missing out entirely.

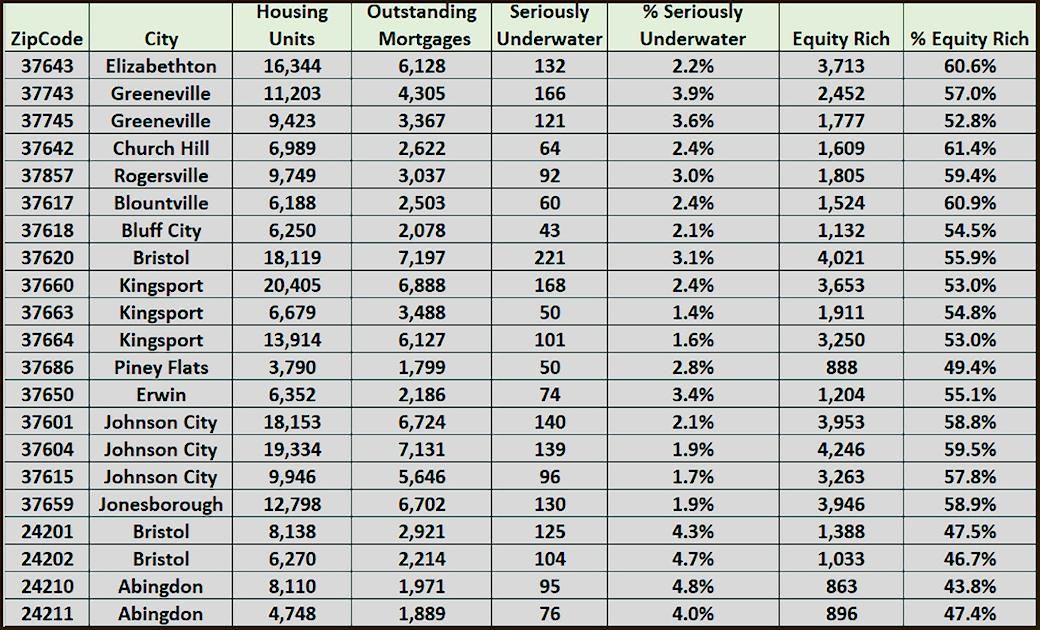

📊 The 2025 Market Snapshot: What Buyers Need to Know

As of Q1 2025, the median U.S. home price sits at $384,500 according to the National Association of Realtors (NAR). Mortgage rates have hovered between 6.4% and 6.9%, and while inventory has modestly improved compared to the pandemic boom years, homes in desirable neighborhoods are still moving quickly—often within 30 days of listing.

➡️ Translation: Buyers who are prepared, informed, and strategic have the best chance of success.

💡 Smart Buyers Do These 5 Things Differently

1.) They Get Pre-Approved Early

One of the biggest mistakes buyers make is starting the home search before understanding their true purchasing power. Getting pre-approved for a mortgage gives you:

- A clear budget

- A competitive edge in multiple-offer scenarios

- Faster closing potential

🔎 Stat: According to Rocket Mortgage, pre-approved buyers are 50% more likely to close on the home they want.

2.) They Work With a Buyer’s Agent—Not Just Any Agent

Having a buyer’s agent on your side gives you access to listings faster, provides expert negotiation support, and often costs you nothing, as the seller typically covers the commission.

✅ Tip: Look for an agent who knows your local market and has experience closing deals in your price range.

3.) They Understand the Full Cost of Homeownership

Beyond your down payment and mortgage, you’ll also need to budget for:

- Closing costs (typically 2–5% of the purchase price)

- Home inspections

- Appraisals

- Insurance and taxes

- Ongoing maintenance

💡 Smart move: Build a buffer of 1–2% of the home’s value annually for repairs and upkeep.

4.) They Move Quickly—but Not Emotionally

In a competitive market, hesitation can cost you the deal. But that doesn’t mean rushing blindly. Smart buyers:

- Know their criteria (location, size, condition)

- Stick to their budget

- Act swiftly once they find a match

📈 NAR reports that 39% of recent homebuyers made offers within 3 days of touring a home—and 24% made an offer sight-unseen. Preparation is key.

5.) They Don’t Skip Inspections or Contingencies

In red-hot markets, waiving contingencies may seem like a way to win. But savvy buyers know the risk of skipping inspections or appraisal clauses.

🛠️ Fact: A 2024 Porch.com survey found that 86% of buyers uncovered at least one issue in their inspection, with the average repair bill landing near $11,000.

🔍 Case Study: How Preparation Paid Off

Michael and Sara were first-time buyers competing in a seller’s market. Instead of chasing listings blindly, they worked with a seasoned agent, got pre-approved with a local lender, and narrowed their search to two neighborhoods. Within three weeks, they found a home listed at $349,000. Their strong offer—with flexible closing terms and no financing hiccups—beat out four others. They closed in under 30 days.

🎯 Their strategy? Preparation + clarity + speed.

🧭 Final Thoughts: Buying a Home Is a Journey—Take the Smart Route

The modern real estate market moves fast, but smart buyers don’t just react—they plan. By understanding your finances, partnering with the right professionals, and staying grounded in data, you can buy with confidence.

Ready to take the first step?

Explore Tri-Cities Properties for sale now on our

Buy With Us page or contact one of our

Real Estate Agents today for personalized guidance through every step of the process. Together, we'll find your dream home!

SHARE THIS POST!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465