Why East Tennessee Buyers and Sellers Are Turning to Hybrid Real Estate Marketing

The Hybrid Real Estate Model

• Traditional MLS Marketing • Savvy Real Estate Agents • Auction Option •

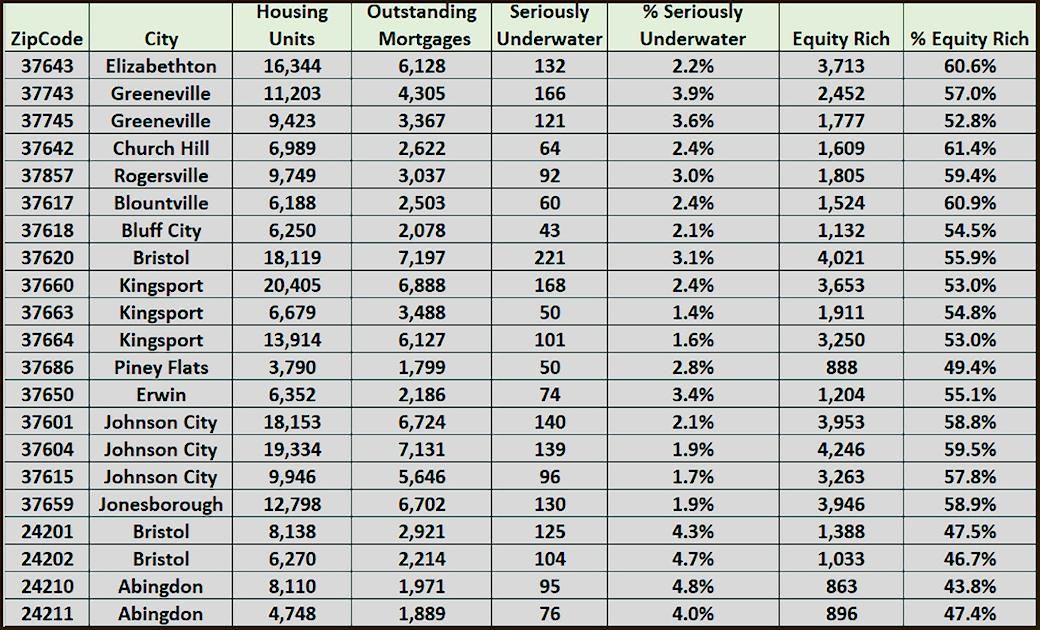

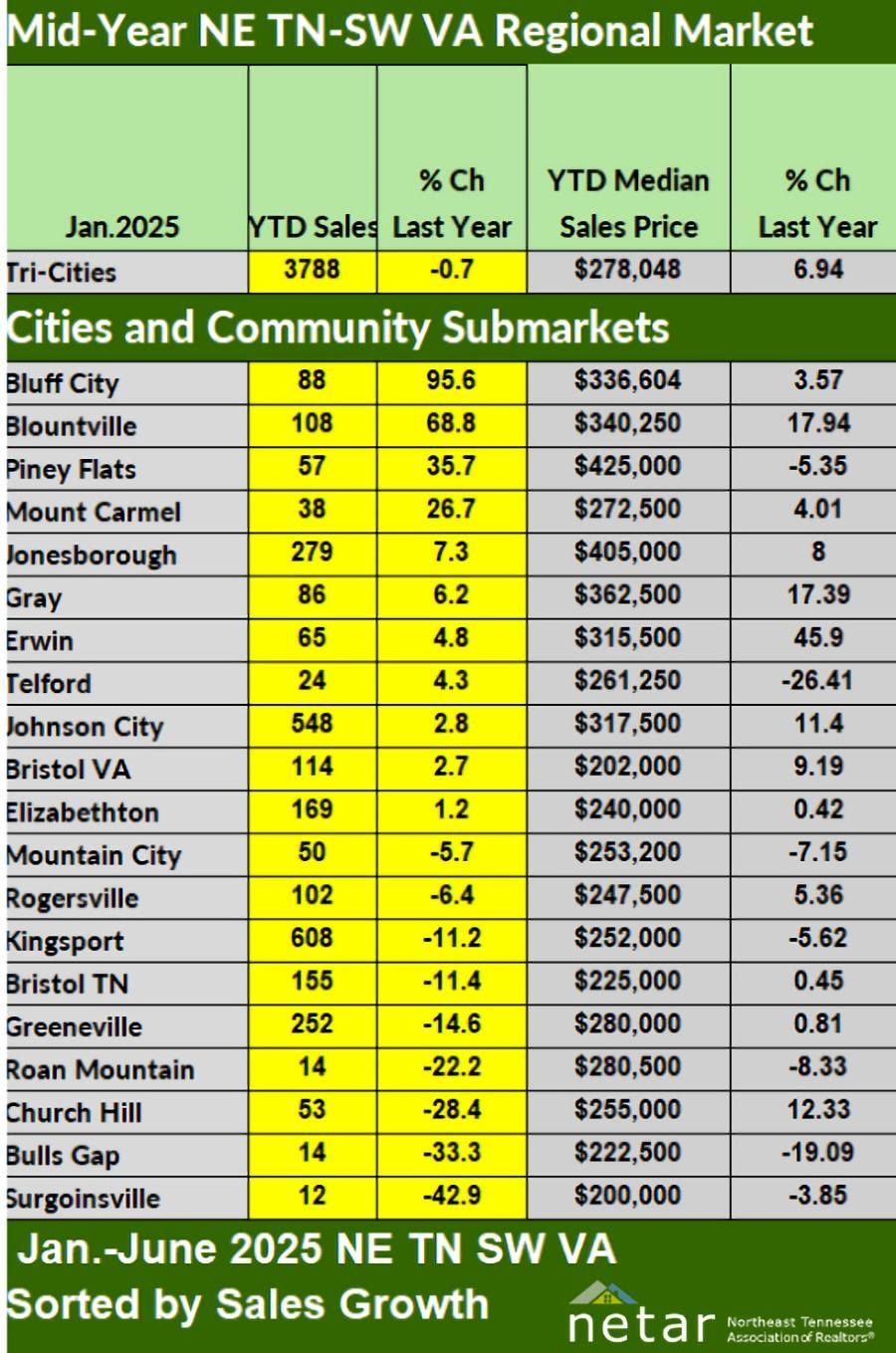

The Tri-Cities real estate market is unique. From residential neighborhoods in Johnson City and Kingsport, to downtown commercial spaces in Bristol, and sprawling farmland throughout the region, every property has its own ideal path to market. At Collins & Co., we’ve built our reputation on a Hybrid Real Estate Marketing Approach, one that combines the power of Traditional MLS Listings, the expertise of savvy Real Estate Agents, and the efficiency of Auctions. This combination allows our clients to achieve results that standard one-size-fits-all real estate methods simply can’t deliver. Here's why!

What Is Hybrid Real Estate Marketing?

Most agencies choose between listing a property on the MLS or offering it at auction. Collins & Co. has found a better way—using both strategies together.

- MLS Marketing: Provides wide exposure to buyers searching online, through syndication on major real estate websites, and agent-to-agent networking.

- Experienced Agents: Guide clients through pricing, positioning, staging, negotiations, and closing.

- Auction Services: Add urgency and competitive bidding to the process, often resulting in faster sales and stronger offers.

By strategically combining these methods, Collins & Co. ensures that every property—whether it’s a starter home, a retail building, or hundreds of acres—gets the right type of exposure to attract serious buyers.

Why Sellers Love It

Hybrid marketing offers sellers flexibility and results. Homes and commercial buildings benefit from the broad reach of MLS listings, while auctions create a sense of urgency and excitement. Sellers often enjoy:

- Faster sales cycles: Auctions push buyers to act, reducing time on market.

- Competitive pricing: Bidding competition drives values up.

- Wider audience reach: MLS visibility captures traditional buyers while auctions attract investors and out-of-area buyers.

Land Sales: Breaking Records in East Tennessee

When it comes to land and acreage, the hybrid method truly shines. Land buyers are often investors, developers, or individuals seeking farmland or recreational property—audiences that respond exceptionally well to auctions.

Collins & Co. has been setting record prices at auction for acreage sales across East Tennessee, proving that our strategy works. By combining MLS exposure with targeted auction marketing, we’ve brought multiple qualified buyers to the table and created bidding environments that maximize seller returns. For landowners, this means two things:

- Faster results than waiting months (or years) for the “right buyer” to come along.

- Stronger prices, driven by real-time competition.

It’s no wonder so many land sellers are turning to Collins & Co. to handle their acreage sales. Learn more about selling land with Collins & Co. here: https://www.collinsandcompany.info/land-seller

Why Buyers Benefit Too

Hybrid marketing isn’t just good for sellers. It helps buyers as well! Auctions create transparent pricing where buyers know exactly what others are willing to pay. Meanwhile, MLS listings allow for due diligence, financing, and longer negotiation periods. Whether buyers are searching for their dream home, commercial space, or investment acreage, Collins & Co.’s hybrid model provides more opportunities to find the right fit. If you are a Tri-Cities Real Estate Buyer, explore our Auctions to find the perfect property at an excellent price! We also encourage you to shop Our Listings and the MLS right from our website. See what's out there! Then, reach out to one of our Professional Real Estate Agents to explore the best option for your needs.

The Collins & Co. Advantage

In a market as diverse as East Tennessee, a cookie-cutter approach doesn’t cut it. Collins & Co. is proud to be one of the few firms in the region offering both MLS representation and professional auction services under one roof. This dual expertise has given us a track record of success and a unique advantage for our clients. Whether you’re selling a home, a downtown storefront, or 100 acres of farmland, our hybrid marketing approach ensures your property gets maximum exposure and competitive offers.

Final Thoughts

The future of real estate in East Tennessee is hybrid. Sellers want speed and strong returns. Buyers want transparency and opportunity. Collins & Co. delivers both, in excess, to each one of our clients. If you’re considering selling property, especially land, our team would love to show you how our hybrid marketing strategy can work for you. Contact us online or call (423) 543-5741 to get started with us today!

SHARE THIS POST!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465