Blog: Handling and Estate? One Call. One Solution. Complete Peace of Mind.

Navigating Estate Responsibilities with Compassion and Clarity

Losing someone special is one of life's most difficult experiences. If you've been chosen as an executor, you're facing both grief and the weight of significant responsibility. Please know that you don't have to navigate this journey alone—and it's okay to ask for help during this challenging time.

Understanding Your Role

As an executor, you're tasked with managing your loved one's estate, which can feel overwhelming when you're already dealing with loss. The process involves numerous steps, from securing the property to distributing proceeds, and it's natural to feel uncertain about where to begin.

The First Critical Steps

Your immediate priorities should focus on protecting what your loved one built. This means securing the property by ensuring doors and windows are locked, changing locks if necessary, and setting alarms. You'll also need to locate vital documents like the will, trust documents, life insurance policies, and bank statements. Don't forget to forward mail and notify utility companies to maintain the home's condition.

Where Most Executors Need Support

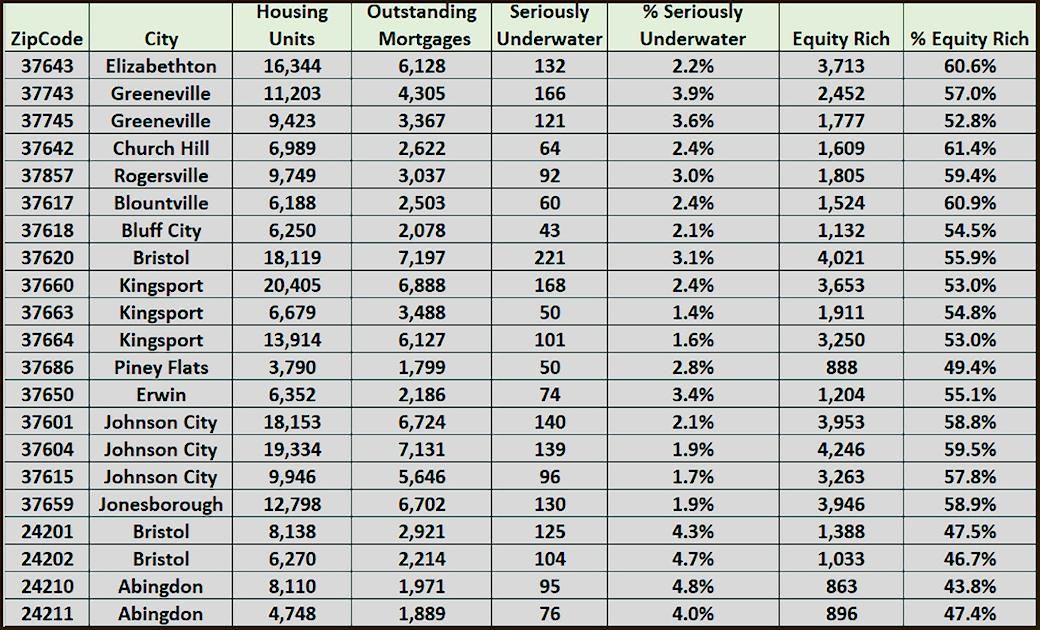

One of the most daunting aspects is determining what items hold value. You might be surprised to discover that seemingly ordinary belongings are actually valuable collectibles or antiques. This is where having an experienced auctioneer by your side becomes invaluable. They can identify hidden treasures and help you make informed decisions about whether a traditional listing or public auction will maximize the estate's value.

The "heavy lifting" of sorting, cataloging, and selling personal property can be emotionally and physically exhausting. Professional auctioneers handle this process with both efficiency and sensitivity, allowing you to focus on healing while ensuring your loved one's possessions are treated with respect.

Peace of Mind Through Partnership

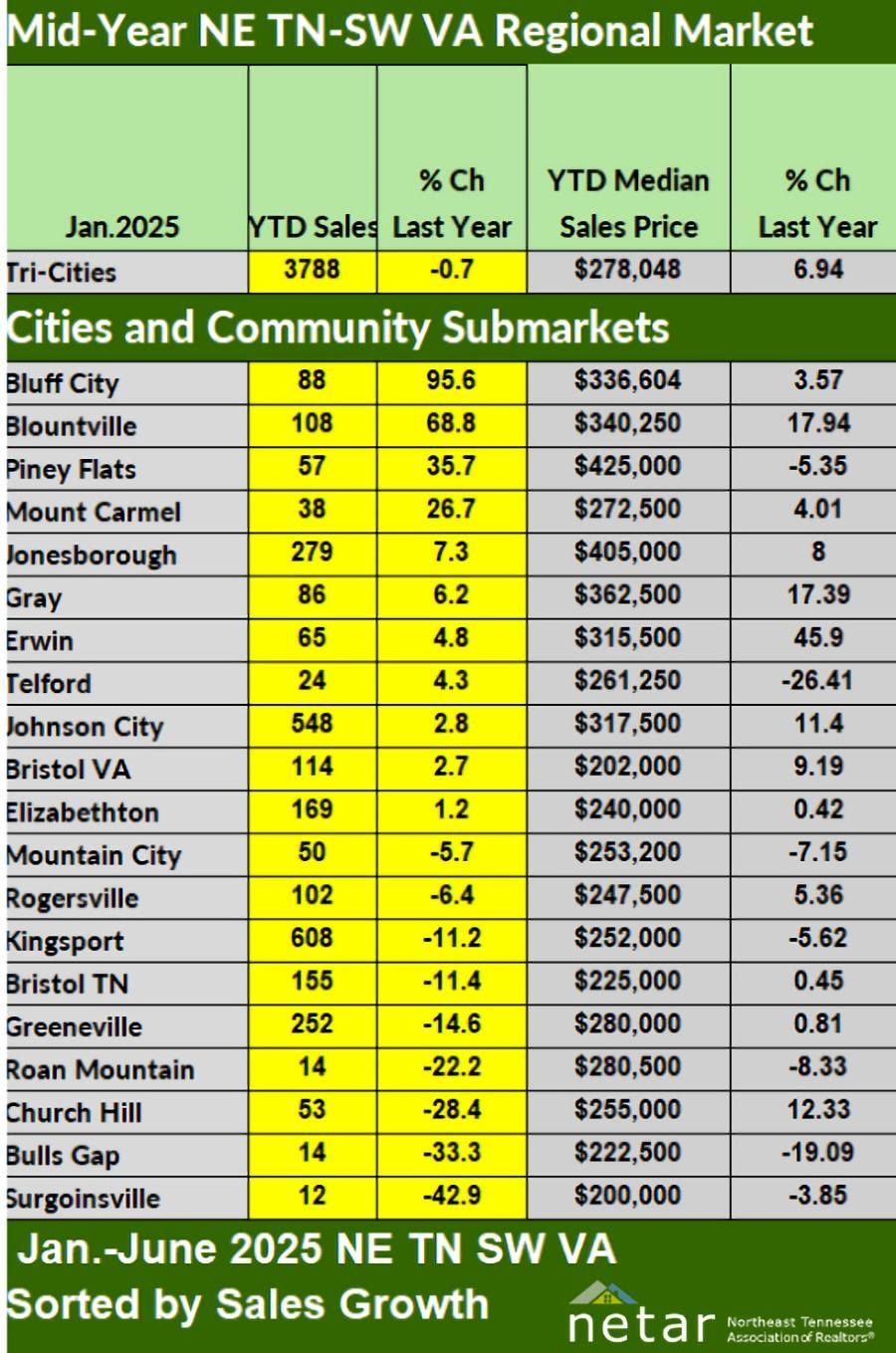

At Collins & Company, we understand that over 70% of executor tasks can feel insurmountable when you're grieving. Our dual-licensed professionals—both Realtors and Auctioneers—bring over 75 years of combined experience to guide you through every phase. From property evaluation and asset management to final settlement and probate paperwork, we work alongside your estate attorney to ensure nothing is overlooked.

We approach each estate with confidentiality, compassion, and a commitment to achieving results that honor your loved one's legacy. You deserve support during this difficult time, and we're here to provide exactly that—one call, one solution, and complete peace of mind.

Remember, seeking professional help isn't a burden; it's a wise decision that honors both your loved one's memory and your own well-being.

SHARE THIS POST!

MARKET PULSE BLOG

East Tennessee Real Estate Updates, Tri-Cities Auction Insights, and Valuable Market Tips!

Collins & Co. Realtors And Auctioneers provides comprehensive real estate and auction services. Voted Best Real Estate Agency, Auction Firm, and Realtors by The Johnson Press and The Elizabethton Star Readers' Choice Awards, you can trust our experts to help you achieve your goals. Come see the difference our professional team of auctioneers and real estate agents can make! Contact us to get started today.

Go ahead... We're listening!

David Collins - Real Estate Broker & Auctioneer

MLS Brokerage #364 - Real Estate Firm #265789 - P.A.L. #4465