By Jacob Force

•

November 4, 2025

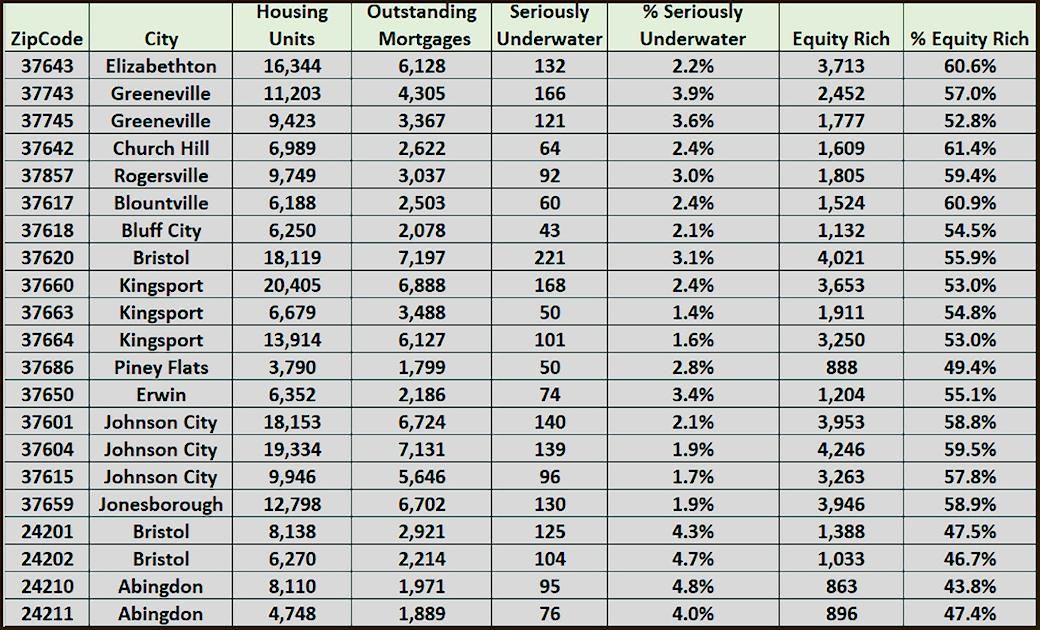

Understanding the Shift in Northeast Tennessee's Home Equity Landscape Recent data from ATTOM reveals a subtle but significant shift in Northeast Tennessee's real estate market. According to Don Fenley at Core Data, the number of equity-rich properties in the Tri-Cities declined by 3.6% during the third quarter, while seriously underwater mortgages increased by 0.4%. While these changes may seem modest, they signal an important transition that could affect local homeowners, buyers, and the broader market. What Does "Underwater" Really Mean? A seriously underwater mortgage occurs when a homeowner owes at least 25% more than their property's current market value—a loan-to-value ratio of 125% or higher. Across the Tri-Cities' 86,923 mortgaged properties, certain areas show higher vulnerability. Abingdon's 24210 zip code leads the region with 4.8% of mortgages seriously underwater, followed by nearby 24202 Bristol at 4.7% and 24211 Abingdon at 4.0%. Meanwhile, communities like Elizabethton maintain stronger equity positions, with 60.6% of properties equity-rich. Market Stabilization After Years of Growth Rob Barber, CEO of ATTOM, notes that "after several years of strong equity growth that peaked in 2022, homeowner equity levels appear to be stabilizing." For Northeast Tennessee, this means the rapid appreciation that benefited many homeowners is moderating. The modest fluctuations suggest our housing market is finding balance rather than experiencing crisis. However, this stabilization presents challenges for specific groups. Homeowners who purchased near market peaks or in areas experiencing slower appreciation may find themselves with limited options. Selling becomes difficult when proceeds won't cover the outstanding loan balance. Refinancing to lower interest rates or access cash becomes nearly impossible when underwater. This constraint keeps inventory tight and may prevent families from relocating for job opportunities or life changes. Implications for Buyers and Sellers For prospective buyers, understanding equity distribution across zip codes provides valuable insight. Areas with higher percentages of underwater mortgages may see fewer listings as constrained sellers wait for values to recover. Conversely, communities like Johnson City's 37604, where 59.5% of properties are equity-rich, may offer more inventory as homeowners have flexibility to sell. Current sellers with strong equity positions—the majority in most Tri-Cities communities—remain well-positioned to make moves. However, anyone who purchased in the past two years should carefully evaluate their equity situation before listing. Looking Ahead The increase in underwater mortgages, though still relatively small compared to national trends, warrants attention. Real estate professionals must help clients navigate this evolving landscape with realistic expectations about pricing and timing. The market isn't in distress, but the era of guaranteed rapid appreciation has given way to a more measured environment where location, condition, and pricing strategy matter more than ever.